Bitcoin Halving 2024: What Will Happen in 20 Days?

The 2024 Bitcoin (BTC) halving process is expected to take place on April 20 and is expected to have significant effects on the crypto market. In particular, analysts are providing insights into the impact on Bitcoin’s price trajectory. The views of analysts Rekt Capital, Robert Kiyosaki and Bitwise CEO Hunter Horsley provide valuable insights.

How will the 2024 halving affect the Bitcoin price?

In a recent YouTube video, Rekt Capital’s analysis outlines the stages of the Bitcoin halving, comparing the 2024 cycle to the 2020 and 2016 cycles. The pre-halving negative phase, characterized by a pullback in Bitcoin price, has also been observed in previous cycles. Similarly, the pre-halving rally phase, marked by new all-time highs, is notable

Notably, historical trends show that the pre-halving rally usually starts around 60 days before the Bitcoin halving event, leading to a surge in BTC price. However, as observed in the current cycle, a recent pullback of around 18% suggests a transition from the pre-halving rally to the final pre-halving pullback phase.

Kiyosaki: Invest in Bitcoin before the Halving

This phase historically involves a pullback, with depth ranging from 19% in 2020 to 29% in 2016. Reminiscent of previous cycles, the recent pullback points to elements of Bitcoin borrowing from different periods. See also Cryptocoin.com As we reported, Robert Kiyosaki’s statement emphasized the importance of investing in BTC “immediately”.

He advocates buying Bitcoin even in small amounts, citing the potential for value appreciation after the halving. For this, he suggests buying Satoshis or investing in the newly launched Spot Bitcoin ETFs. Moreover, Kiyosaki’s bullish outlook coincides with his expectation that the Bitcoin price will reach $100,000 by September 2024, underscoring his confidence in Bitcoin’s long-term prospects.

What is Bitwise CEO Hunter Horsley’s perspective?

Additionally, Hunter Horsley, CEO of Bitcoin ETF issuer Bitwise, provided valuable insights into the financial implications of the 2024 Bitcoin Halving. He highlighted the significant reduction in BTC mining supply and its potential impact on market dynamics. Comparing the upcoming halving to the previous halving in 2020, Horsley focused on the dollar terms of the supply reduction.

During the 2020 Halving, Bitcoin was priced at around $9,000. This led to a daily drop in supply of around $9 million, resulting in an annual reduction of around $3 billion. However, with the Bitcoin price hovering around $70,000 until the 2024 Halving, Horsley predicts a more significant impact.

It estimates that the daily reduction in supply will exceed $32 million and the annual reduction will exceed $11 billion. This exponential increase in the dollar value of the supply reduction underscores the growing importance of the 2024 Halving event. Horsley’s analysis suggests that the combination of a larger reduction in supply and increased demand for Bitcoin could lead to a more pronounced impact on the market. The significant reduction in natural selling pressure and increased investor interest could contribute to a potential surge in the Bitcoin price following the Halving.

BTC price close to 70 thousand dollars

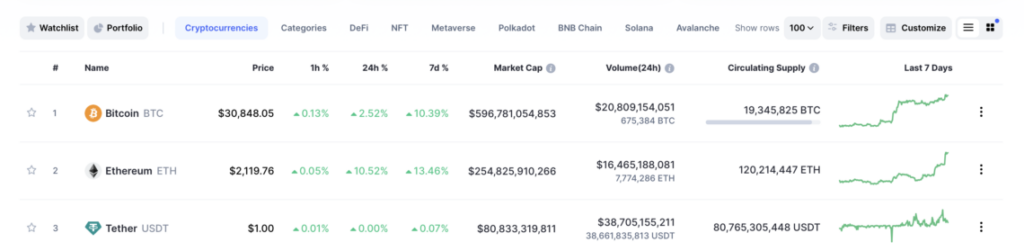

Meanwhile, the Bitcoin price successfully held the $70,000 level. Moreover, it could set the stage for a big rally after the halving event. At the time of writing, the BTC price was up 0.55% to $70,392.78 on Sunday, March 31. On the other hand, the cryptocurrency’s market capitalization was $1.38 trillion. In contrast, 24-hour trading volume fell 25.24% to $17.55 billion. Meanwhile, Michaël van de Poppe, a popular crypto analyst, provided a bullish outlook for the Bitcoin price.

Poppe pointed out that Bitcoin settled around $70,000 in a week of sideways movement. He added that this reflects a period of consolidation in the Bitcoin market. According to his analysis, this stabilization follows the broader trajectory of Bitcoin’s four-year cycle. Moreover, Poppe’s predictions suggest that despite current price levels, Bitcoin could be on track to surprise many investors in the long run. He predicts that a price of $70,000 per Bitcoin in five years could be considered “cheap”, indicating the potential for exponential growth.

English

English