Giant Hedge Funds Are Bearish on Bitcoin: They Set a Record with Their Bets

Bitcoin (BTC)’s meteoric rise appears to have hit a snag as hedge funds anticipating a potential price decline have turned to record short positions. This newfound bearishness comes despite the upcoming halving of the mining reward, an event historically associated with significant price increases for the cryptocurrency.

Short Bitcoin positions on CME raise concern

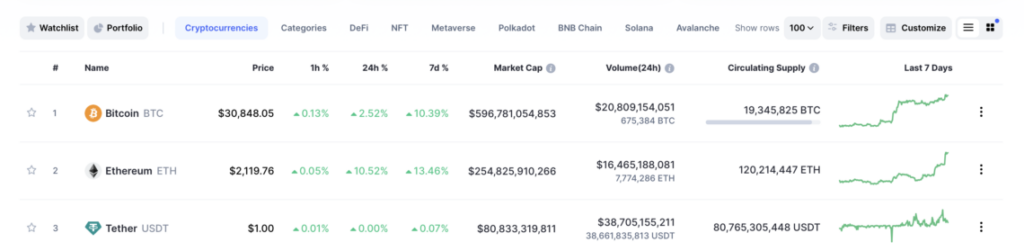

Hedge funds increased their net short position in the Chicago Mercantile Exchange’s (CME) standard Bitcoin futures contracts to a staggering 16,102 at the end of the first quarter, according to data from the Commodity Futures Trading Commission (CFTC). This marks the highest level of bearish bets since the futures contracts were launched in late 2017.

These short positions represent a trading strategy where traders aim to profit from a fall in the price of the underlying asset. In the case of Bitcoin, short sellers can anticipate a price drop and buy back futures contracts later at a lower price, pocketing the difference.

What does the rise in short selling mean?

Analysts believe that this increase in short positions reflects renewed interest in “carry trading” among hedge funds. This strategy involves buying the underlying asset (Bitcoin) on the spot market while simultaneously opening short positions in futures contracts. The rationale for this lies in the current premium on CME futures contracts, where the annual quarterly premium is trading above 10%. This premium essentially allows carry traders to profit in the short term regardless of Bitcoin’s price movement.

“There is a huge demand from hedge funds to enter current trading,” said Markus Thielen, CEO of 10x Research. “Despite the recent price decline, the futures premium remains high and hedge funds are taking advantage of these attractive rates,” he added. But the motivations behind these short positions may not be solely profit-driven. Cryptocoin.com As we have reported, recent hawkish comments from the FED and strong economic data have dampened near-term rate cut expectations. This could potentially weaken Bitcoin’s status as a hedge against inflation, leading some hedge funds to take outright bearish bets.

Halving complicates things for BTC

The halving of the mining reward, scheduled for later this month, further clouds the outlook. Historically, halving events that reduce the amount of new bitcoin created have been followed by significant price increases. But some analysts are skeptical. David Duong, head of institutional research at Coinbase, said:

While past performance suggests an upward trajectory, the small sample size makes it difficult to draw firm conclusions. The introduction of spot exchange-traded funds (ETFs) in the US earlier this year is fundamentally changing market dynamics. These ETFs have attracted billions of dollars of investment, potentially changing how Bitcoin responds to the halving compared to previous cycles.

The launch of these ETFs was in stark contrast to previous cycles, allowing Bitcoin to hit record highs before the halving. This raises the possibility of a price correction after the halving event. Analysts at JPMorgan even predict that the price will fall to $42,000 once the excitement surrounding the halving subsides.

English

English