Bitcoin Falls Below Critical Support: What Do Analysts Expect?

Bitcoin lost all the gains it made last Saturday. The leading cryptocurrency visited below the critical $60,000 level on Wednesday. After a brief rise above $64,000 earlier today, it fell as low as $59,900. Thus, BTC also tested its weakest point since early March.

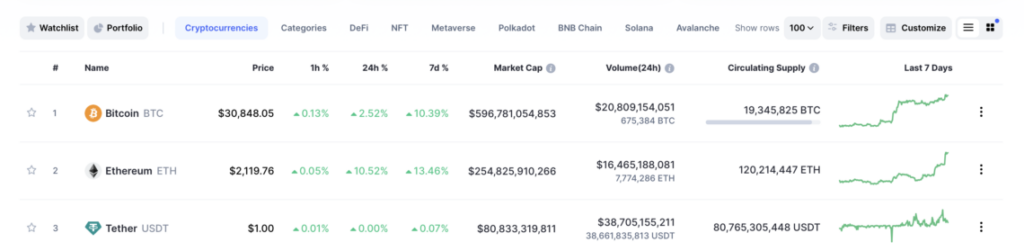

Current trading dynamics for Bitcoin

Cryptocoin.comBitcoin, the leading cryptocurrency, has lost significant altitude today. Thus, it also gave back its gains from earlier in the week. However, the most active Bitcoin trading pair on Binance (BTC-USDT) shows a large number of buy orders stacked below $60,000. Buy orders are more dominant than sell orders. This indicates a strong market demand that could prevent further losses at these low levels.

However, Bitcoin fell over 15% from its most recent peak. Altcoins also suffered losses ranging from 40% to 50%. According to Glassnode’s data, such declines reflect typical behavior in previous bull market corrections. But despite visible buying zones, large investors are hesitant to buy the dip.

BTC’s technical outlook points bearish!

The Wyckoff method, a popular technical analysis tool, is also potentially pointing to further declines. Recent analysis by Stockmoney Lizards via a tweet shows that Bitcoin is currently in the so-called “sign of weakness” phase of the Wyckoff Distribution Model. This is a stage characterized by a reduction in demand. It usually leads to a possible price drop.

We will be live in our free discord channel im 1hr (8 pm CET and talk about #Bitcoin and the current correction https://t.co/o7NHLOL2d3

– Stockmoney Lizards (@StockmoneyL) April 17, 2024

From a technical perspective, BTC price saw a rejection from the $70,000 resistance level. It then moved towards retesting the $60,000 support zone. According to the analyst, a break below this could possibly lead to a sharp drop towards the $55,000 level. Conversely, if Bitcoin can surpass $68,000 again, reaching new highs could be just around the corner. However, the Relative Strength Index (RSI) is currently below 50%. Therefore, the probability of a crash is high. That is, it is likely to lead to potentially serious market consequences.

Bitcoin ETFs are bleeding!

This situation is exacerbated by external economic factors such as the Federal Reserve’s continued high interest rate policy and rising tensions over the Iran-Israel conflict. Therefore, these developments are pushing investors to stay risk-averse. Since the start of the Iran-Israel conflict on April 12, Bitcoin ETFs have seen outflows of around $150 million. This indicates a broad-based flight from riskier assets.

English

English