DWF Labs Gives Good News: TOKEN and These 7 Altcoins are Now on the List!

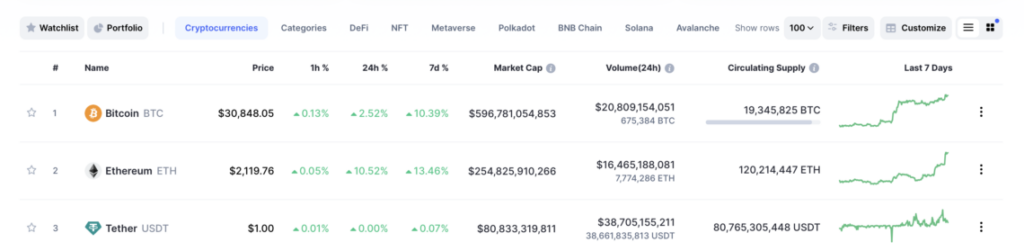

The cryptocurrency market is heading into the weekend with a calm course. The leading crypto Bitcoin is struggling to maintain the 64 thousand dollar level. Altcoins also have a generally stagnant outlook, with exceptions. In this environment, DWF Labs, one of the giant market makers, announced its decision to list 8 new altcoin pairs on the over-the-counter market.

These 8 altcoins made DWF Liquid Markets’ list!

Cryptocoin.comAs you have been following from DWF Labs, the market structure DWF Labs often comes to the agenda with its crypto investments. In addition, DWF Labs is also working to expand its institutional-level OTC trading platform. In this context, it announced that it has added trading pairs for 8 altcoins on its OTC platform, DWF Liquid Markets. These altcoins are: TokenFi (TOKEN), Symbiosis (SIS), Xai (XAI), bitsCrunch (BCUT), Clearpool (CPOOL), beable (BBL), Nakamato Games (NAKA) and World Mobil Token (WMT). In this context, DWF Labs made the following announcement:

We have great news for our traders. New listings are now available on DWF Liquid Markets. Here are the available trading pairs:

TOKEN/USDT, SIS/USDT, XAI/USDT, BCUT/USDT, CPOOL/USDT, BBL/USDTN, AKA/USDTW and MT/USDT.

We have great news for our traders. 🔥 New listings are now available on DWF Liquid Markets.

The trading pairs available are:

– TOKEN/USDT (@tokenfi)

– SIS/USDT (@symbiosis_fi)

– XAI/USDT (@XAI_GAMES)

– BCUT/USDT (@bitsCrunch)

– CPOOL/USDT (@ClearpoolFin)

– BBL/USDT… pic.twitter.com/UoL3KObSYI– DWF Labs (@DWFLabs) April 26, 2024

The relationship between Bitcoin’s price and ETF outflows is weakening

Recently, outflows from Bitcoin exchange-traded funds (ETFs) have increased significantly. Despite this, the leading cryptocurrency is trading above $64,000. Market data shows that the total daily net outflows of US-listed ETFs totaled $217 million. This brings the total outflow so far this week to $244.49 million. According to JPMorgan, the correlation between Bitcoin ETF prices and inflows has weakened. Accordingly, it has fallen from a high of 0.84 in January to 0.60 in recent assessments. Therefore, this suggests that the alignment between BTC prices and spot ETF flows has diminished.

In contrast, Bitcoin has risen around 3.7% in the last week.

In contrast, Bitcoin has risen around 3.7% in the last week.Given its size, the outflow from Grayscale’s converted Bitcoin ETF (GBTC) is of particular interest to traders. Data from SoSoValue shows that since Monday, GBTC experienced an outflow of $417 million last week. However, BTC prices have seen an increase despite this. According to GoinGlass, liquidation data has also been fairly flat. In this context, $60 million worth of liquidations took place in the last 24 hours. Of this $60 million, BTC accounted for $13.48 million. In addition, $6.17 million worth of long positions were liquidated to about $7 million worth of shorts.

English

English