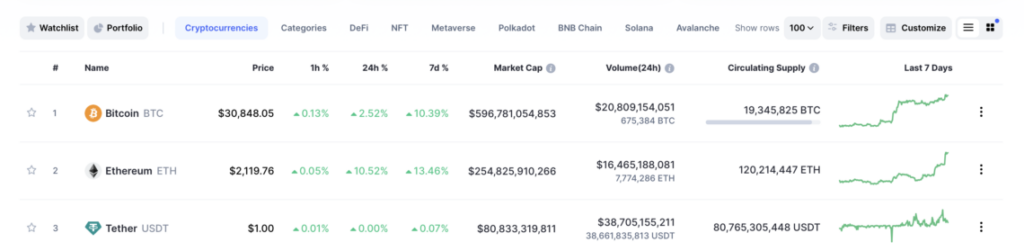

Analyst: That Cryptocurrency is Ready to Explode to These Levels!

Bitcoin, the leading cryptocurrency, suffered a big drop this week. In the process, it returned to the levels of two months ago. Moreover, this drop affected the sentiment of the cryptocurrency market. In a bearish market, traders started to favor short positions. According to crypto analyst Vinicius Barbosa, this could lead to a ‘short squeeze’ in the coming weeks.

There is a possibility of ‘short squeeze’ for the leading cryptocurrency!

In particular, long traders lost $400 million in liquidations during the crash as fear, uncertainty and doubt (FUD) prevailed. This long squeeze rebalanced Bitcoin’s derivatives market, clearing out most of the long positions opened. As a result, the market’s open interest (OI) was weighted towards short positions. Thus, it reached record negative funding rates since the beginning of the year. Data from CoinGlass shows that BTC’s OI-weighted funding ratio is at its worst levels in 2024.

Essentially, negative funding rates mean that Bitcoin short sellers have to pay interest to long traders for holding their positions. This is a mechanism to keep short positions balanced between longs and shorts, even during high volatility events.

BTC OI-Weighted Funding Ratio, 8 hours. Source: CoinGlass

BTC OI-Weighted Funding Ratio, 8 hours. Source: CoinGlassBitcoin ‘short squeeze’ and possible price targets

BTC was trading below the key resistance level of $60,000. This level is important from both a psychological and technical analysis perspective, given that it has been a strong support since March. Therefore, it is possible that breaking through $60,000 could lead to a sentiment shift towards ‘fear of missing out’ (FOMO). Thus, large pools of collateral liquidity will become BTC price targets for market makers. This is likely to trigger two potential ‘short squeeze’ events.

Notably, Bitcoin has $1.72 billion worth of short seller liquidation at $71,715. However, CoinGlass’ 1-month heatmap also shows significant liquidity pools at $67,420. There are also smaller pools around both key zones. A ‘short squeeze’ could reward Bitcoin traders with gains of 14% and 21% from $59,200 to the first and second liquidation levels, respectively.

BTC Liquidation Heatmap, 1-month chart. Source CoinGlass

BTC Liquidation Heatmap, 1-month chart. Source CoinGlassA potential ‘short squeeze’ and a gain of over 14% is an optimistic outlook. Still, investors should be cautious about trading Bitcoin. This is due to macroeconomic concerns about the Fed’s interest rates. Also, microeconomic concerns about Bitcoin miners’ revenue decline affecting network security. In this context, investment experts from Standard Chartered bank predict that BTC will reach between $52,000 and $50,000 in the short term. However, cryptocurrencies, including BTC, have high volatility. Therefore, it is difficult to predict further performance.

The views and forecasts in the article are those of the analyst and are not investment advice. Cryptocoin.com we strongly recommend that you do your own research before investing.

English

English