Bitcoin Forecasts After Hot US CPI Show These Levels!

Today’s US CPI came in above expectations. Moreover, banks such as JPMorgan, Citi, Goldman Sachs forecast that the US CPI will rise in the coming months. This has put the Fed’s rate cut in doubt. Now, analysts’ Bitcoin forecasts are pointing to lower levels.

Bells are ringing for $100,000 Bitcoin predictions!

The US Bureau of Labor Statistics announced the March Consumer Price Index (CPI) as 3.5%. This exceeded expectations of 3.4%. The CPI was the most influential data to resolve the debate on the timing of the Fed’s rate cuts. However, Wall Street banks predict that inflation will rise before it starts to cool again. Against a backdrop of a resilient US economy, the latest data means the Fed is likely to keep cutting rates for longer.

Bitcoin is witnessing headwinds such as the US dollar, 10-year Treasury yields and regulatory tightening. However, halving activity is on the supportive side. However, experts predict that higher inflation will make it difficult for Bitcoin to rise to $100K.

Wall Street expects hotter inflation in the coming months

JPMorgan, Citi, Goldman Sachs, Morgan Stanley, Barclays, HSBC, UBS, BMO and Citadel expect inflation to remain high in the coming months. Most banks expect CPI inflation to be higher at 3.4%. Earlier, Fed swaps showed that rate cuts were off the table in June and July. At that time, the benchmark was pointing to September for the Fed to cut rates. However, following the latest developments, Fed swaps now indicate that rate cuts are expected in November.

FED SWAPS SHIFT FULL PRICING OF RATE CUT TO NOVEMBER FROM SEPT

– *Walter Bloomberg (@DeItaone) April 10, 2024

On the other hand, CME FedWatch Tool indicates that there is a 51% probability that the Fed will cut interest rates by 25 basis points in June and 49% in July. The tool points to a 40% probability of another 25 basis points cut in September.

Fed will probably be patient!

JPMorgan Chief Executive Officer (CEO) Jamie Dimon warned earlier this week that interest rates of up to 8% are still on the table due to continued inflationary pressures from fiscal deficits and military conflicts, among other factors

The US dollar index (DXY) rose to 105 after falling to 104 today. Fed officials, including Neel Kashkari and Jerome Powell, emphasized the need for more inflation data before considering any rate cuts. Also, Fed officials have gradually become cautious. Meanwhile, US 10-year Treasury bond yield rose from 4.35% to 4.5% after the CPI. Thus, it reached the highest level since November. Bitcoin is moving in the opposite direction to the DXY and the 10-year Treasury yield. With CPI inflation coming above 3.2%, the Fed is likely to be patient!

Bitcoin forecasts point to lower levels!

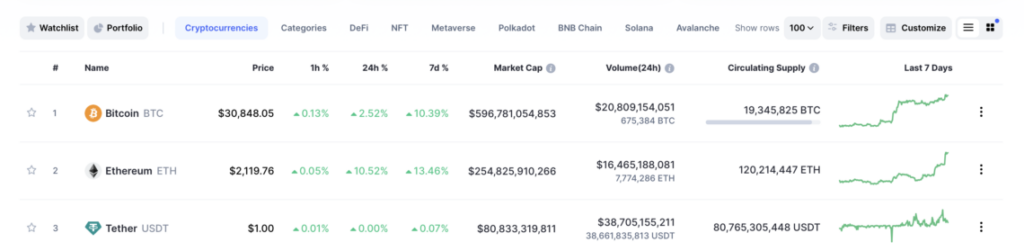

Analysts remain bearish on Bitcoin due to halving-related volatility. Among Bitcoin predictions, Markus Thielen predicts that the BTC price will fall to $62,000. He also predicts that the ETH price will drop to $3,100 due to lack of trading volume. According to the analyst, investors should carefully monitor important levels such as $68,330 for Bitcoin and $3,460 for Ethereum.

Analysts such as Benjamin Cowen and Peter Brandt predict that the Bitcoin price will fall below $60,000 if BTC repeats a historical pattern seen during the spot Bitcoin ETF and past halving events.

English

English