Critical Day for These Two Cryptocurrencies, Famous Forecaster Expects a Boom!

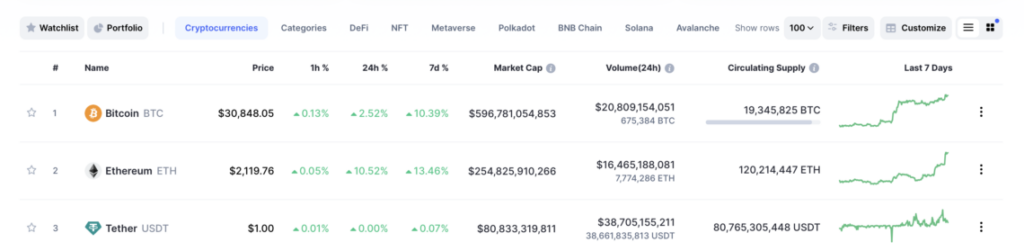

Today is very important for the two leading cryptocurrencies. Because more than 96,000 Bitcoin options with a face value of $6.2 billion will expire. Also today, 990,000 Ethereum options with a face value of $3.1 billion expire. Meanwhile, BitMEX co-founder Arthur Hayes gives a strong bullish signal.

Can the two cryptocurrencies recover after the expiry of options?

Today, around $6.3 billion worth of BTC options will expire. This signals potential downside price volatility that could cause Bitcoin to fall to the $61,000 level. After these options expire, traders expect a rebound in Bitcoin and the crypto market. Therefore, this is likely to stop profit-taking on downside hedges.

More than 96,000 Bitcoin options with a notional value of $6.2 billion will expire on Deribit. The put-call ratio is 0.68, indicating a recent increase in put options as the monthly expiration approaches. The maximum pain point is $61,000. This is below the current price. The market is expecting a pullback in the price on expiry day. So, a big volatility in the market is possible.

Also, 990 thousand Ethereum options with a face value of $3.1 billion will expire. These options have a put-call ratio of 0.51. The maximum pain point for Ethereum is $3,100. Therefore, it is below the current ETH price of $3,141. This indicates a slight pullback.

Pmarket sentiment remains low

Deribit shows that the BTC Volatility Index (DVOL) has risen sharply as crypto options expiry approaches. This suggests that realized volatility is rising. Options expert Greekslive said that low cryptocurrency market volume this week pushed Bitcoin and Ethereum prices to trade near support levels. This market weakness led to significant declines in implied volatility (IV) across all major futures. DVOL has also fallen by as much as 15% since halving. The lack of volatility in the market led to a large number of options being sold.

Moreover, market sentiment remains low due to the recent spot Bitcoin ETF outflows. According to experts, the chances of BTC returning to ATH levels are extremely low as it will face more resistance.

Arthur Hayes: Predicts Crypto Market Recovery

BitMEX co-founder Arthur Hayes shared his views on the markets following recent developments. Hayes said that there is an important bull signal for the crypto and equity markets. Macro factors stand out as the primary reasons behind the recent drop in sentiment in the crypto market. Thus, Hayes noted that tax receipts from US citizens added $200 billion to the US Treasury Department’s Treasury General Account (TGA) and that the next steps could bring a rebound in the markets. In this context, Hayes shared the following assessment:

Janet Yellen will trigger a rally in stocks and crypto markets if any of the following three options are considered:

- Reducing the NPL to zero and stopping Treasury bond issuance, which would be a $1 trillion liquidity injection.

- It shifts more borrowing to Treasury bills to take money out of the RRP, which would mean a $400 billion liquidity injection.

- The combination of 1 and 2 would be a $1.4 trillion liquidity injection. The Treasury could halt long-term bonds and issue bills while reducing NPL and RRP.

As expected tax receipts added roughly $200bn to TGA. Forget about the May Fed meeting the 2Q24 refunding annc comes out next week. What games will Yellen play, here are some options:

1. Stop issuing treasuries by running down the TGA to zero, that is a $1tn injection of… pic.twitter.com/F6AsShYhr4

– Arthur Hayes (@CryptoHayes) April 26, 2024

Hayes expects the crypto bull market to re-accelerate should any of these three options materialize. Markets are also watching the Fed’s preferred measure of inflation, the PCE inflation release today, for further guidance on the direction of prices over the next few weeks. Cryptocoin.comAs you have been following from ‘As you know, the annual PCE rate is expected to rise for the second consecutive month to 2.6% from 2.5%, while the annual core PCE inflation is expected to fall to a three-year low of 2.6% from 2.8%.

English

English