FED Chairman Speaks! What’s Next for Bitcoin Price?

The recent inflation expectations of FED officials led by Chairman Jerome Powell attracted attention. In particular, they made statements about the potential for interest rate cuts. Thus, the statements affected various financial markets, including cryptocurrencies such as Bitcoin. Here is the impact of his speech on the Bitcoin price…

FED Chair speaks, the market’s expectations for Bitcoin price soared

On Wednesday, April 3, in his speech at Stanford Graduate School of Business, Powell emphasized that recent data on both employment gains and inflation have exceeded expectations. He emphasized the importance of moving towards the Fed’s 2% inflation target before considering a significant rate cut. Powell emphasized that there is a general consensus among policymakers about the possibility of a rate cut later in the year, but that such steps can only be taken if confidence in the trajectory of inflation increases.

Powell’s cautious stance on rate cuts has implications for various asset classes, especially Bitcoin and other cryptocurrencies, which tend to be sensitive to changes in monetary policy. A delay in rate cuts would lead to longer consolidation periods for risk-bearing assets like Bitcoin. This is because high interest rates often act as a disincentive for their growth.

Powell’s statements are already affecting cryptocurrencies

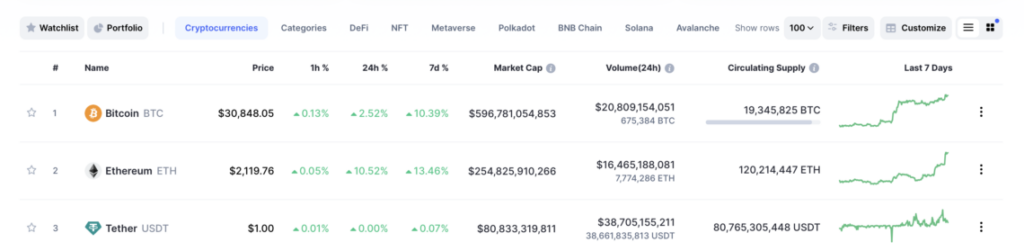

Powell’s statements have already affected the cryptocurrency market and Bitcoin is experiencing downward pressure. Cryptocoin.com as we reported, Santiment reported that the price of Bitcoin fell to $65.5k. This then affected the broader cryptocurrency market. Over the past seven days, there has been a drop in overall market capitalization and trading volume. This signals a period of consolidation and uncertainty.

Despite the short-term pressure on the Bitcoin price, institutional demand for the crypto remains strong. Names like Robert Kiyosaki have voiced their support for Bitcoin as a hedge against inflation. In particular, they have emphasized the potential of Bitcoin alongside traditional safe-haven assets such as gold and silver. But Powell’s remarks also point to a potential sentiment shift that could positively impact cryptocurrencies in the long run

Powell also affects the traditional market

It is worth noting that Powell’s remarks not only impacted the cryptocurrency market, but also had broader implications for traditional financial markets. Indices such as the NASDAQ and S&P 500 experienced significant price swings in response to Powell’s comments, reflecting the interconnectedness of various asset classes within the global financial system.

As a result, Jerome Powell’s cautious approach to interest rate cuts is critical. Because it brought uncertainty to financial markets and affected assets such as Bitcoin and stocks. Short-term volatility may continue. However, the long-term outlook for cryptos is influenced by the FED’s evolving stance on monetary policy and inflation.

English

English