Halving is 10 Days Away: Good News Bitcoin Forecast from Analyst!

Just ten days before the highly anticipated Bitcoin halving, the cryptocurrency finds itself in a precarious position. The price is currently hovering above the crucial level of $70,000, reinforcing the optimistic forecasts of analysts predicting a major price increase. However, fundamental concerns over profit-taking and the Fed’s tightening of liquidity are clouding this bullish outlook. Here are Bitcoin forecasts and expectations from various analysts

Bitcoin forecast for after the halving: Will there be a price explosion?

Analysts at Bitfinex paint a rosy picture, suggesting a potential 160% price increase following the halving. This bullish forecast, based on a regression model, translates into a price range between $150,000 and $169,000 over the next 14 months. This optimism is backed by Bitcoin’s strong weekly performance, currently up over 7.5%.

But analysts also acknowledge a potential obstacle: unprecedented selling pressure. Unlike previous halving cycles, Bitcoin had already hit an all-time high before the event. They suggest that this has potentially encouraged investors who bought above $60,000 (representing a significant portion of the circulating supply) to cash out their profits.

ETF inflows attracted attention

More Cryptocoin.com As we reported, the FED’s quantitative tightening policy, which aims to reduce liquidity in the market, may reduce Bitcoin’s post-halving rise. Arthur Hayes, co-founder of BitMEX, thinks that this tightening will lead to a drop in prices. He then predicts that this could potentially trigger a “violent sell-off” in crypto assets.

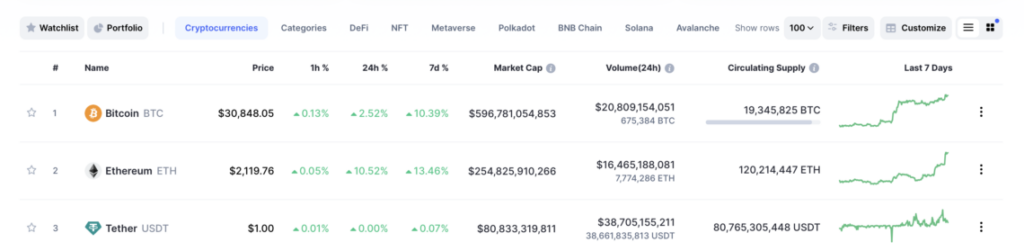

The recent surge in Bitcoin ETFs (Exchange Traded Funds) has played an undeniable role in the price rally. These investment vehicles, particularly US-based spot ETFs, were responsible for around 75% of new Bitcoin investments when the price surpassed $50,000. While the inflows have significantly boosted Bitcoin’s price, they have also raised concerns about its long-term sustainability. Currently, Bitcoin ETFs hold 841,900 BTC, representing the bulk of the circulating supply. The current accumulation model suggests that these ETFs could potentially absorb 2.6% of the total annual supply.

Watch out for BTC in the coming weeks

As a result, the coming weeks will be crucial for Bitcoin. The halving itself is a bullish event that could significantly impact the price. But the interplay between profit-taking pressures, macroeconomic factors and the evolving role of Bitcoin ETFs creates uncertainty. It remains to be seen whether Bitcoin will meet optimistic forecasts or face a post-halving correction. One thing is certain: The next ten days will be tense for the world’s leading cryptocurrency.

English

English