Institutional Money Exiting Bitcoin and ETH Enters Those 6 Altcoins!

Leading cryptoasset investment firm CoinShares has released its latest weekly report on Bitcoin and altcoin asset fund flows. The figures revealed a worrying trend for Bitcoin bulls. Investors withdrew money from crypto funds for the third consecutive week, marking the largest outflow since March 2024 and raising questions about investor confidence in the market.

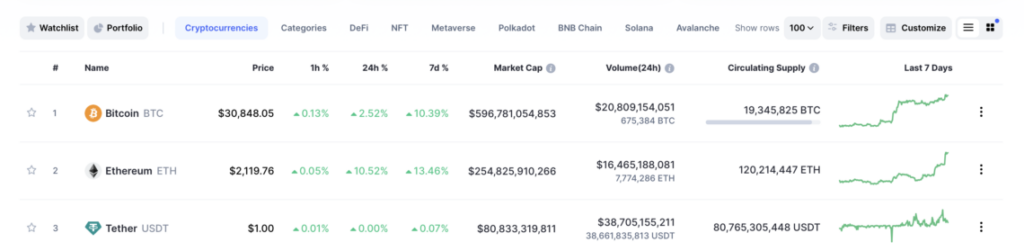

A big breakout for Bitcoin

The report details outflows totaling US$435 million, with Bitcoin taking the brunt of these withdrawals at US$423 million. This coincides with the recent 6% drop in Bitcoin prices, potentially suggesting a link between investor sentiment and price movement.

While the decline in outflows from Grayscale is a positive sign, the overall slowdown in inflows is worrisome. Grayscale, the current leader in the ETF (Exchange Traded Fund) space, witnessed outflows of USD 440 million, but this represents the lowest outflow in nine weeks. However, this was overshadowed by a significant drop in inflows from new ETF issuers, which fell to USD 126 million from USD 254 million last week.

What do regional trends point to?

The report also highlights a regional trend, with the US leading the outflow charge at USD 388 million. Despite this negative trend, it is important to note that year-to-date inflows to the US remain positive at a record high of USD 13.6 billion. Germany and Canada seem to reflect the US sentiment with outflows of USD 16 million and USD 32 million respectively. However, Switzerland and Brazil offer a glimmer of hope, registering inflows of USD 5 million and USD 4 million respectively.

Optimistic for altcoin enthusiasts

Looking beyond Bitcoin and Ethereum (which saw US$38 million in outflows), the report offers a ray of light for altcoin enthusiasts. A wide range of altcoins witnessed inflows, with investors opting for multi-coin investment products (USD 7 million) and favorite altcoins such as Solana (USD 4 million), Litecoin (USD 3 million) and Chainlink (USD 2.8 million) continuing to gain traction. Apart from SOL, LTC and LINK, there were inflows of around $500K for XRP, ADA and DOT.

CoinShares’ report paints a picture of a cautious market. While Bitcoin’s dominance is undeniable, investor confidence is wavering, leading to outflows. The slowdown in inflows from new issuers further reinforces this concern. However, continued interest in altcoins suggests that investors are not abandoning the crypto space altogether, but are instead looking for diversification and potentially higher returns outside the top two coins.

The coming weeks will be crucial to observe whether this trend continues or whether investor confidence has recovered. The future direction of Bitcoin prices and the overall health of the crypto market will likely depend on this outcome.

Follow us to be instantly informed about breaking news Twitter’Also, Facebookand InstagramFollow them on Telegram and Youtube join our channel.

English

English