The Crisis Prophet Who Defended These Crypto and 2 Assets Said ‘Collapse is Coming’ Again!

American author Robert Kiyosaki, known for his popular personal finance books, used his X platform to warn his millions of followers about the “everything bubble” in US stocks, bonds and real estate. The financial commentator predicts that this bubble is “ready to collapse”. He also recommends Bitcoin, the leading cryptocurrency, gold and silver.

New comment from Kiyosaki

Robert Kiyosaki, author of the best-selling personal finance book “Rich Dad, Poor Dad”, sent shockwaves through the financial world with his recent statements on social media. Known for his outspoken views, Kiyosaki warned his millions of followers that an “everything bubble” involving US stocks, bonds and real estate was approaching. Predicting that this bubble is “ready to collapse”, he urged his followers to invest in gold, silver and the leading crypto Bitcoin as hedges.

The EVERYTHING BUBBLE, stocks, bonds, real estate SET to CRASH. US debt increasing by $1 trillion every 90 days. US BANKRUPT. Save your self. Please buy more real gold, silver, Bitcoin.

– Robert Kiyosaki (@theRealKiyosaki) April 7, 2024

But Kiyosaki’s dire prediction is far from universally accepted. While some investors share his concerns, historical data offers a more nuanced view. According to Reuters, the only real post-World War II stock market bubble burst occurred during the dot-com boom of the early 2000s. Back then, internet companies saw inflated valuations that ultimately led to a brutal bear market.

The difference between the dot-com bubble and today

But there is an important difference between the dot-com era and today’s market. The business media point out that current corporate balance sheets are generally healthy. This financial stability suggests that the constant warnings about an “everything bubble” may be overly pessimistic. SocGen’s Albert Edwards, on the other hand, suggests that some stocks are showing signs of a bubble, particularly in the burgeoning field of artificial intelligence. Edwards suggests that the current euphoria of this sector may be unsustainable.

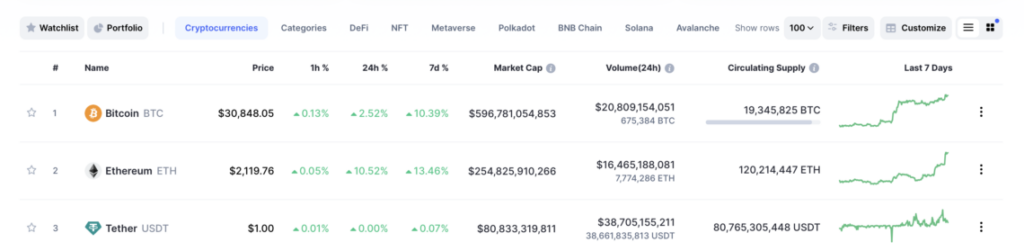

Bitcoin, the leading crypto, in Kiyosaki’s focus

The effectiveness of Kiyosaki’s proposed hedges (precious metals and Bitcoin) is also a matter of debate. In 2022, Bitcoin’s price fell along with US stocks as the FED raised interest rates to fight inflation. This drop raised questions about Bitcoin’s ability to diversify a portfolio. But 2024 may paint a different picture. Jurrien Timmer, global macro director at Fidelity Investments, points to a recent development: Bitcoin’s negative correlation with the S&P 500. This newfound dynamic makes Bitcoin a potentially more attractive diversification vehicle.

So, is a major market crash coming? The answer, as is often the case in finance, is complex. While Kiyosaki’s warning should not be completely dismissed, historical data and current economic indicators point to a more cautious approach. Investors should be aware of the potential risks but also consider the health of corporate finance. Cryptocoin.com As we have reported, Robert Kiyosaki is also known for predicting the 2008 financial crisis.

Bitcoin’s evolving relationship with the stock market also deserves close attention. Ultimately, the best course of action may be to strategically diversify your portfolio to include a mix of assets with different risk profiles. It is also crucial to conduct thorough research and familiarize yourself with market trends before making any investment decision.

English

English